Last month we celebrated Onam, a festival in Kerala to welcome demon king Maveli, who once ruled Kerala. Mahabali was allowed to visit Kerala once a year to see his people. As per Hinduism, lord Sri Krishna takes different incarnations to restore Dharma (cosmic law). Maveli was chased out of Kerala to restore Dharma. Kerala is a land for several sacred temples. So, it is not clear whether Onam is celebrated to welcome Mahabali, or to show Mahabali the glory of Kerala in his absence. Now, its time to review last 6 years of LDF rule in Kerala. People in Kerala look at chief minister Pinarayi Vijayan as both demon and God. It depends on their political ideology.

Kerala State government distributed free Onam-Kit (groceries) for everyone through fair price shop. The idea was to help the poor to celebrate festival with Sadhya (a special meal for the occasion). I don’t know from how long this practice is in Kerala, but people like it.

Law and order:

Law and order in Kerala is worse than ever under present LDF rule. Kerala claims to have achieved 98% literacy rate and is free from communal disharmony. In Kerala, we don’t have cosmopolitan city like Mumbai, Delhi, Chennai or Bangalore, where floating population exists. Yet, the crime rate in Kerala is worse than several other states in India.

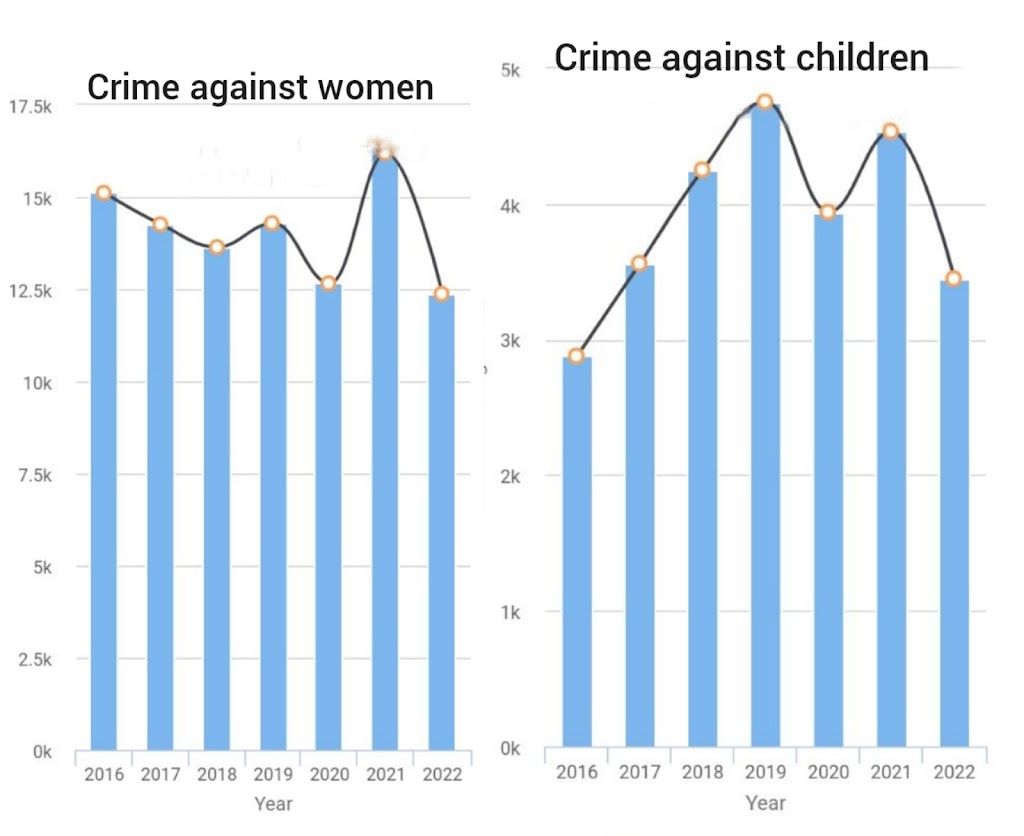

It is the duty of police to maintain law and order, which essentially means preventing crimes. Kerala chief minister who handles home department failed to maintain law and order in Kerala. Below is the picture from official website of Kerala police and it shows the graph of crime against women and children since 2016.

On 16 September 2021, The times of India reported that Kerala has highest charge-sheeting rate for violent crimes. It was based on National crime records bureau (NCRB) report for the year 2020. Now the National crime records bureau report 2021 is published and there isn’t any improvement. In fact, the numbers have gone up slightly. These figures in NCRB report are based on charge sheets. It is needless to say that in India, thousands of crimes will go without a charge sheet every year.

Kerala’s crime rate under protection of children from sexual offences (POSCO) Act is 23 per lakh, which is way above the National average of 10.50. Kerala stands at 8th position in recidivism. High rate of recidivism is due to police protecting habitual offenders for politicians and wealthy. Police will ensure loop holes while preparing charge sheet and FIR, in return for bribe. These habitual offenders can come out on bail and continue to serve their bosses in police, politics and the wealthy lot. Today, we see more unruly police officers in Kerala than in Uttar Pradesh and Bihar. Below chart gives you the numbers of top eight states in recidivism.

Economy:

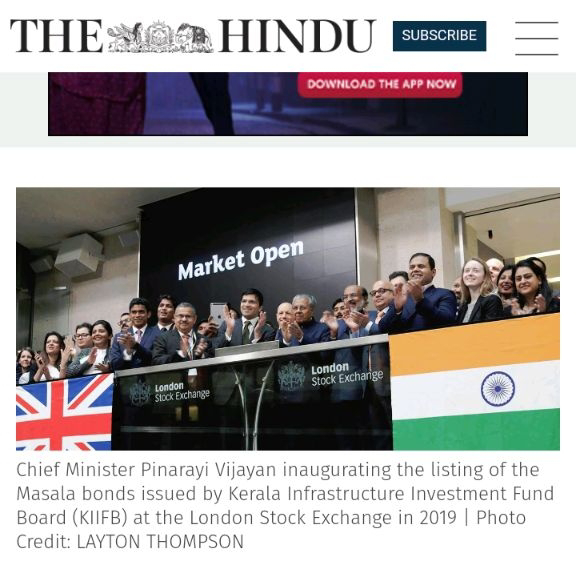

Kerala’s public debt has almost doubled in the last six years from ₹1,89,768.55 crore in 2016-17 to ₹2,32,291 crore as of March 2022. Reserve Bank of India (RBI), comptroller and auditor general (CAG) and the Congress led UDF has already raised this concern time and again. CAG didn’t accept Kerala government’s argument that Kerala infrastructure investment fund board (KIIFB) and Kerala social security pension Ltd (KSSPL) barrowing are not direct liabilities of the state and are only guaranteed by the state government.

In March 2022, Union finance minister Nirmala Sitharaman and the department of expenditure stipulated that for the purpose of fixing the ceiling in state’s borrowing, borrowing by state public sector companies, corporations, special purpose vehicles, and other equivalent instruments, would be treated as borrowings made by the state itself.

The union government has set the barrowing limit of 3.5% of GSDP. The union government will convey the net barrowing ceiling for each state at the beginning of the fiscal year. Union government plans to adjust all the incremental off-budget barrowing since 2020-21 due to pandemic from this year’s ceiling. The union government allows another 5% of GSDP of additional borrowing for undertakings in specified power sector reforms. And a further leeway which is equivalent to state’s contribution into the national pension system for government employees.

There was a steep rise in revenue expenditure in committed liability, from 61.22% in 2016-17 to 68.01% in 2020-21. Committed liabilities are salaries of government employees, pension, etc. And the Gross state domestic product (GSDP) has risen from 20.43% in 2019-20 to 27.07% in 2020-21.

CAG has observed that the state government should focus on the growth of it’s own tax revenue and should take measures to improve it. Kerala’s revenue from revenue receipt decreased from 55.78% in 2016-17 to 48.82% in 2020-21, despite the increase in revenue receipt by 13%. May be it is time for Kerala government to increase the amount collected through revenue receipt.

Kerala was identified as one of ten states with highest debt burden, based on the debt-GSDP ratio as per the risk analysis done by RBI in June this year. The RBI analysis identified Kerala as ‘highly stressed’ state. According to the analysis, Kerala is also among 3 states where the debt to GSDP ratio is projected to exceed 35% by 2026-27. Debt to GSDP ratio indicates the state’s ability to pay back debts. This analysis and projection is based on the state’s present debt and the expected revenue growth. The RBI analysis didn’t include projects like SilverLine and several other expensive plans of LDF government in Kerala.

Kerala is a state where we often come across news about government employees doing odd jobs, because government didn’t pay their salary. Kerala is the only state where employees of corporations run by government like KSRTC will approach high court to get their salaries. In May this year, Kerala government deferred salaries of state government employees, as it failed to get the loan of ₹4000 crore to finance state’s expenditure.

The LDF government is hell-bent on SilverLine construction. The project is not financially viable. The ridership projection as per the survey by French consultancy SYSTRA is nearly double the Mumbai- Ahmedabad bullet train, which connects two busiest cities in India. Now the government wants to extend SilverLine till Mangalore with an additional cost of ₹6000 crore.

Tamilnadu chief minister MK Stalin said while addressing the 30th Southern zonal council meeting in Thiruvananthapuram that projects like SilverLine are more economical, more efficient and less polluting than aeroplane and automobiles. He urged centre to create a high-speed rail corridor connecting cities in Tamilnadu like Chennai, Coimbatore, Tuticorin, Madurai and to neighbouring states. Ideas like SilverLine and expensive projects in every state is absurd. Such projects will take at least another 6 to 8 years to complete. It is very likely to have at least one Vande Bharat train running in every state by 2028, without any additional debt burden on states. They run at a top speed of 180 KMPH. Every state government going with their own design and railway line will create a mess. They cannot be integrated with Indian railways in the future.

If Tamilnadu chief minister MK Stalin is after big projects to make name, fame and money, or if the cooperation between Tamilnadu and Kerala is so good, then he can consider constructing a new dam in Mullaperiyaar to replace the existing dilapidated dam. The dam and the amount of water stored there is risk to lives and livelihood of thousands of people in Kerala. Construction of new dam and a new agreement between Kerala and Tamilnadu will increase revenue for Kerala government. It will be beneficial for Tamilnadu in the long run. Or, Tamilnadu chief minister can consider constructing a new dam within Tamilnadu boarder to reduce the load on Mullaperiyaar dam and to help farmers in Tamilnadu.

KSRTC has announced in a press release that it had decided to purchase 700 CNG buses for the price of 1300 diesel buses. The government said that as per 2021 tender, buses that run on CNG costs ₹37.99 lakhs, whereas a diesel bus costs only ₹33.78 lakhs. The government said that they save on fuel price, as CNG is relatively cheaper than diesel after all the increases in the last two years, which made CNG price ₹85 per KG. So, the government plans to purchase 700 CNG buses which will increase the state’s debt burden by another ₹26000 crores through KIIFB. Now the gas price has gone up by another 40%. So, Kerala government can reconsider their decision to purchase CNG buses.

Transport minister Antony Raju said last month that KSRTC will provide ₹756 crores to buy electric buses through KIIFB. One would wonder why Kerala government is on a spending spree, when the state’s economy is in Shambles? The answer is; in August this year, union minister for road transport, Nitin Gadkari announced that 250 electric buses will be granted to Kerala’s KSRTC under ‘fame India scheme’. So, ministers in Kerala wants to make people believe that it is their achievement when they get the electric buses.

KSRTC running in loss from several years in Kerala is failure of subsequent governments. Karnataka’s KSRTC is running profitably from few decades and is among the best in Asia.

Roads in Kerala:

Pathetic condition of roads in Kerala talks volumes about corruption in Kerala. Kerala has allocated 3% of its total expenditure on roads and bridges, which is lower than the average allocation by states which is 4.3%. Vigilance department found irregularities in road construction by local bodies in Kerala. Samples from 150 roads were taken and the officials believe that at least 110 roads have irregularities. Officials said that they can ascertain irregularities only after the review of samples. Irregularities were found in at least 20 roads maintained by Kerala public works department.

Kerala ranks bad in GST collection:

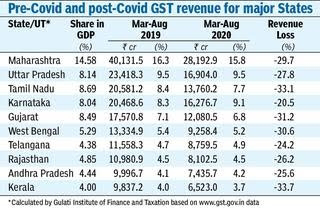

Poor GST collection will impact both state and union government’s revenue. GST is collected at where the good/service is consumed and not at where it originates. ‘GST collection across states: Whither Kerala’ by N Ramalingam and Santosh Kumar Dash, faculty at the think-tank Gulati Institute of finance and taxation (GIFT) based in Thiruvananthapuram states that, in terms of per capita consumption, Kerala tops other states whereas in per capita tax collection, it is in eighth position.

In Kerala, we come across several small industries running without GST registration and they have 5, 10 or 15 men working there every day. These are industries like plywood factories, metal fabrication works, asbestos products manufacturing units, wood mills, commercial vehicles workshop, etc. They will have their own sad story and probably will contribute generously to political parties, when they go for party fund collection. Allowing such leeway will adversely affect the state government’s revenue.

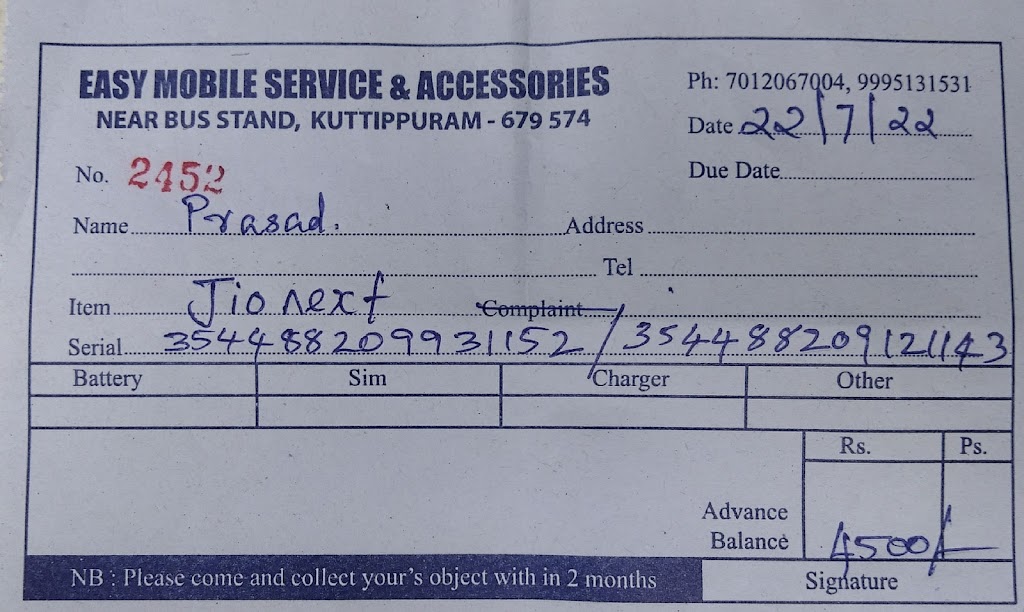

I recently purchased a Jio phone for ₹4500. When I demanded invoice, they gave me a bill which didn’t have GSTIN in it. The shop is not registered and do not have GSTIN. Obviously, the phone’s price includes GST and it is billed by someone at some point during the supply chain. The shop from where I purchased phone will sell handsets worth ₹1,500 to ₹10,000. They also sell accessories, recharge mobile currencies, they service and do maintenance for mobile phones and tablets. Many of the accessories they sell are China made and the margin could be as high as 70%. The shop’s turnover could be 3 to 5 thousand a day or even more. This means, we don’t collect tax from someone whose monthly turnover is 1.5 lakhs or even more. The government gets nothing and the entire transaction is unaccounted. Same is the story with apparel stores, where they have 5 to 10 sales boys and girls. They pay around ten thousand as building rent, but does not have GSTIN and the entire transaction they do is unaccounted. Same is the story with footwear stores. Below is the picture of my mobile bill.

I live in a small town, where there are more than hundred stores. If all of them were to have GSTIN, then at least 5 auditors will get job and the government revenue will increase. But, Kerala government seems to be fine with it.

At least 60% of two wheelers running across Kerala do not have valid insurance certificate. Kerala government may pay Ex-gratia from public money, in the event of a death in road mishap. But that’s not what law says. Otherwise, Kerala government will earn GST when motor insurance is sold and the risk will be taken care by the insurer. Kerala government will also earn by collecting fine for not insuring vehicles.

We have scrapyards in every towns and cities in Kerala, who are allowed to do business without any checks and balances. In other states, the government will at least consider periodic inspection to see if they are collecting government and railway property, because it cannot be traced once it is melted. But Kerala government seems to be very casual about it.

Across Kerala, there are hundreds of scrap collectors who are from Tamilnadu. Tamilnadu has more industries than Kerala. But these Tamilians come to Kerala because it is more lucrative here. Many of them were in Kerala from more than 8 to 10 years. They go to collect scrap from households with a three or four wheeler. These people do not have any identity card from Kerala. The scrapyard owners and the landlords whose house they rent also will not have their Tamilnadu identity cards in most of the cases. The three and four wheeler which they bring from Tamilnadu will run without Kerala state permit. And there are vehicles owned by scrapyard owners which are neither roadworthy, nor they have any valid documents. The people from Tamilnadu who work for scrapyards will pay their house rent in Kerala, pay for their vehicle maintenance, they pay for vehicle loan and even send money to their native. They earn more than one thousand a day. They even steal brass, copper, aluminium utensils or any metals, if found lying outside and if residents are not at home.

The monthly turnover of scrapyards under whom there are four to five people earning thousand a day will be more than 1.5 lakhs and the entire transaction is unaccounted. Kerala government should consider collecting a fixed amount from scrapyards every month through local government bodies like municipality, if not GST.

Poor public health care in Kerala:

In 2021-22 budget, Kerala has allocated 6.5% of its total expenditure on health, which is higher than the average allocation for health by states which is 5.5%.

In 2020-21, Kerala spent 5.5% of its total expenditure on health which was marginally higher than the average expenditure of 28 states.

In 2019-20, the revised estimate for the department of health and family welfare matched the budget estimate of ₹62,659 crore. The budget estimate was overshot by ₹50 crore.

In 2018-19, Kerala spent 7.4% of the general government expenditure (GEC) on health, which was higher than many other states. Kerala’s per capita total health expenditure was the highest in the country in 2018-19 at ₹9871. So, it is a lot of public money spent by the state government every year.

The government doctors in primary health care centre, as well as in Medical Colleges are in a hurry to clear the queue in OPD. The doctors are not ready to stay in hospital for a full shift. They need rest, because they have private practice, where their treatment is effective.

In primary health care centres, the treatment is often on trial and error basis. Often the patients who visit government hospitals with flu, vomiting, acidity, dehydration, etc. will have to make multiple visits. Some of them will visit private practice of government doctors or private hospitals, if their ailment is not cured even after a week.

Government doctors blame government pharmacy for not having the kind of medicines prescribed in private hospitals. In other words, they are saying that the drugs in government pharmacies are not effective. If it is true, then there is no point in spending thousands of crores every year.

Health minister Veena George’s recent explanation that rabies virus is faster than the vaccine is not at all acceptable, especially when there is speculation that government is purchasing substandard vaccine for kickbacks. Rabies vaccine were there in the market from quite sometime and they should be faster than health minister’s beliefs. Vaccine manufacturers know that people won’t walk around with vaccine, where they can administered it immediately after dog bite. If there are more people dying due to dog bite even after administering vaccine, then they should investigate it.

When the government is spending so much for public health care, the health care should be somewhat satisfactory, if not the best. The government can either accept the reality and work on improving. Or, they can think of an alternative option for public health care.

Kerala’s strange liquor policy is helping poisonous toddy sale:

Kerala government has the highest sales tax on liquor in the country at 254%. This liquor policy of Kerala is designed to promote the sale of spurious toddy. In neighbouring states like Tamilnadu, Karnataka, Andhra Pradesh and Telangana, a quarter bottle (180ml) of cheapest rum, brandy or whisky will cost only ₹105. The same is sold in Kerala for ₹180 and above. A quarter bottle of whiskey available for ₹105 is more potent than a litre of spurious toddy. The bottled whisky is distilled beverage, which is edible and is free from poisonous chemicals. The government will get sales tax for selling it, and there is less scope for big bribe. On the other hand, in toddy 90% is profit out of which two third is given to politicians and bureaucrats. They have toddy tappers union who are also the beneficiaries of this crime and they have a say in politics too. It also has caste angle of toddy tappers, but the motivation is money involved in the crime. Sri Narayana Guru, a saint from the caste who does toddy tapping preached not to extract and sell toddy. The government may say that it is to help coconut farmers. Only a small percentage of coconut farmers will benefit from toddy tapping, because 90% of toddy sold across Kerala is water with chemicals in it. Coconut farmers get reasonable price for coconut oil and coconut.

Above are the reasons for Kerala government limiting the number of bars and slapping 254% sales tax on bottled liquor. All the liquor stores in Kerala are owned by the government. In neighbouring states like Karnataka, liquor stores are run by private party and one will see a liquor store in two kilometre radius in cities. In small towns, you see liquor store in every alternate street. And that won’t make them drink all day and night.

Subsequent governments in Kerala said that the sales tax on liquor is kept so high to stop poor people from consuming alcohol. Sales tax on liquor in Kerala is a major source of income for government. The reality is that the sales tax on liquor is kept so high to create market for toddy. And those poor who choose to drink three pegs of Whisky or Brandy will contribute all his day’s earning to government coffer.

A glass of natural sweet toddy extracted in the morning is good for health. By evening, the same toddy will ferment and becomes sore. The soar toddy is intoxicative, but not harmful. But the toddy sold in Kerala’s toddy shops are made by mixing various poisonous chemicals and psychotropic substances to water. A small quantity of natural toddy is added to this mix to get the flavour. Some of the chemicals used to make artificial toddy are, Sodium Lauryl Sulphat (SLS), Saccharin, Silicone paste, Marijuana, Ammonium chloride, lead, chloral hydrate, sulphate Ash and Benzoic acid.

An article published in The Hindu and Manorama will help you understand how this spurious toddy is produced. There were similar articles published in other newspapers as well. Komalan and Unni tried to stop the sale of toddy legally, but they failed. The sale of poisonous toddy continues unabated in Kerala.

I am sure that people will not drink toddy, if they get to know the actual health hazards of drinking toddy. When you drink 3 pegs of bottled liquor like Whisky or Brandy, you can experience your body becoming warm, smooth blood circulation and you will feel the intoxication all over your body. But consuming toddy will make only your head go numb, you will have burning sensation in your intestine and liver. One will be addicted to toddy if consumed for few days regularly. The addiction or the affinity is not that of alcohol. The addiction and affinity one experiences is that of psychotropic substances like marijuana. It is because of the use of marijuana and other hypnotic drugs in artificial toddy making. If there is someone of the opinion that they enjoy sex more when high on alcohol, then the effect of toddy in your body will be right opposite of it. Yes, drinking potent toddy will reduce your potency.

In Kerala, thousands of poor people are diagnosed with Liver disease, Gastro esophageal reflux disease, Appendix, Ulcer, Cancer, Heart problems, etc. None of them are diagnosed with ailments caused by poisonous toddy. We only get to see news about few hundreds dying or loosing their sight. This usually happens, when the spurious drink is prepared by those who are intoxicated. Otherwise, even if the disease is related to drinking habit, the blame will be on alcohol and not on toddy. What rights do our government has to go after peddlers (who sell Marijuana and psychotropic drugs), when the government is issuing licence to sell psychotropic drink twice a year?

It is mandatory for cigarette sellers to have a picture of cancer affected lungs on every packet. The image should be more than half of the size of cigarette pack. The statutory warning should be written in bold letters. The same law is applicable for all tobacco products. Even the liquor bottles should have a statutory warning. Health officials will walk into any restaurants and harass them for lack of hygiene, for not following safe cooking and serving norms, for not disposing food waste scientifically. They don’t spare even the street vendors. Nestle’s Maggie noodles was banned for finding lead contents in it. But none of these rules are applicable for toddy.

Kerala government can pump money into coffer by issuing licence for private entities to open liquor stores across Kerala. A reduced tax on liquor will stop poor people from drinking poisonous toddy. Why should working people wait in the queue for an hour to purchase liquor. Those who spend ₹600 out of their day’s earning of ₹800, will be able to buy liquor worth ₹300 and can contribute the rest for their household expenses. If toddy is banned, then every bottle of liquor sold at reduced tax ( Say 100%) will increase government’s revenue than what it earns now at 254%.

Kerala should be able to increase its revenue and shouldn’t make this state carry a huge debt burden without any credible source for repayment. Kerala government should refrain from approaching union government for more and more debt, unless there is a situation like 2018 deluge. Chief minister of Kerala can consider resigning and dissolving his cabinet, if they cannot manage state’s economy.

The union government may require ‘operation lotus’ in Maharashtra and Karnataka to topple state governments. But in Kerala, denying all sorts of borrowing above the state’s stipulated ceiling will be enough to overthrow the LDF government.

Please follow and like us: